Your browser does not support the video tag.

FUTURES TRADING FOR THE BOLD

###### Go with a trusted broker for unpredictable markets.

WHY TRADE FUTURES

FEATURES FOR YOUR PORTFOLIO

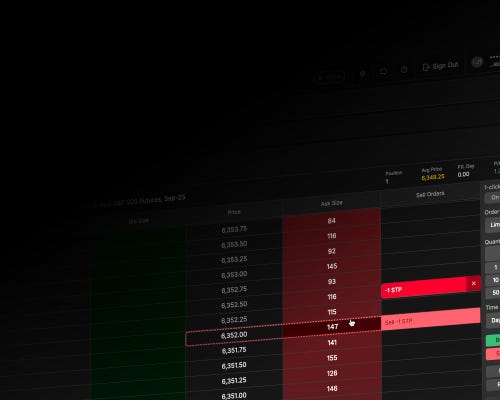

Trade Faster with One Click

!arrow

View charts and ladder side by side. Trade with confidence in every market move.

Monitor Your Risk

!arrow

Keep a watchful eye on your portfolio with our suite of Risk Analysis tools including SPAN scenarios, Allocation, and Cap Requirement.

Customize Your Views

!arrow

Visualize trends, identify patterns, and make data-driven decisions with Curve, Table, Grid, and more dynamic trading views.

Analyze Your Portfolio

!arrow

Monitor the impact of your moves across your portfolio with ETF-specific Delta, Buying Power, visualized P&L, and more cross-portfolio tools.

Trade Faster with One Click

View charts and ladder side by side. Trade with confidence in every market move.

Monitor Your Risk

Keep a watchful eye on your portfolio with our suite of Risk Analysis tools including SPAN scenarios, Allocation, and Cap Requirement.

Customize Your Views

Visualize trends, identify patterns, and make data-driven decisions with Curve, Table, Grid, and more dynamic trading views.

Analyze Your Portfolio

Monitor the impact of your moves across your portfolio with ETF-specific Delta, Buying Power, visualized P&L, and more cross-portfolio tools.

WHAT YOU CAN TRADE

Ready to Conquer the Futures Market?

Clear Pricing, No B.S.

We don’t charge for gold, we trade it on the futures market.

| Product | Opening Commission | Closing Commission |

| --- | --- | --- |

| Futures | $1

per contract | $1

per contract |

| Micro/Mini Futures | $0.75

per contract | $0.75

per contract |

| Options on Futures | $1.25

per contract | $1.25

per contract |

| Options on Mini/Micro Futures | $0.75

per contract | $0.75

per contract |

| Product | Opening Commission |

| --- | --- |

| Futures | $1

per contract |

| Micro/Mini Futures | $0.75

per contract |

| Options on Futures | $1.25

per contract |

| Options on Mini/Micro Futures | $0.75

per contract |

| Product | Closing Commission |

| --- | --- |

| Futures | $1

per contract |

| Micro/Mini Futures | $0.75

per contract |

| Options on Futures | $1.25

per contract |

| Options on Mini/Micro Futures | $0.75

per contract |

Other fees apply.

Keep Yourself Sharp

Quick courses that prepare you for the futures market, no matter how experienced you are.

Your browser does not support the video tag.

FREQUENTLY ASKED QUESTIONS

##### How do you buy and sell futures?

You can buy and sell futures on the tastytrade trading platform by following our steps here. The tastytrade trading platform also offers the active trader interface, purpose-built for active futures traders.

##### How much money do I need to start trading futures?

With tastytrade, there’s no minimum account balance to trade CME futures in a margin account.

But if you’re trading in an IRA, start-of-day net liquidation must be $25,000 for standard CME futures contracts and futures options and $5,000 for CME micro E-mini futures and CME options on micro E-mini futures. Whichever account you use, you need to ensure that overnight requirements are met.

##### What is the difference between futures and options?

While both options and futures are derivative products in isolation, futures options are derivatives of the specific futures contract you're trading. Like an equity market, where options settle to the underlying stock, futures options settle to the underlying futures contract, and that futures contract eventually settles to cash or a physical product. The difference between equity options and futures options is that futures contract prices can differ from month to month as each futures contract has a unique contract code, where equity options settle to the underlying stock or ETF.

For more information, read Futures vs. Options: What Are the Differences?

##### Can I trade futures at night?

Yes, you can trade futures day and night. However, some contracts have specific trading hours. With a tastytrade account, futures trading is available to you 23 hours a day for most products.

Learn more about market trading hours